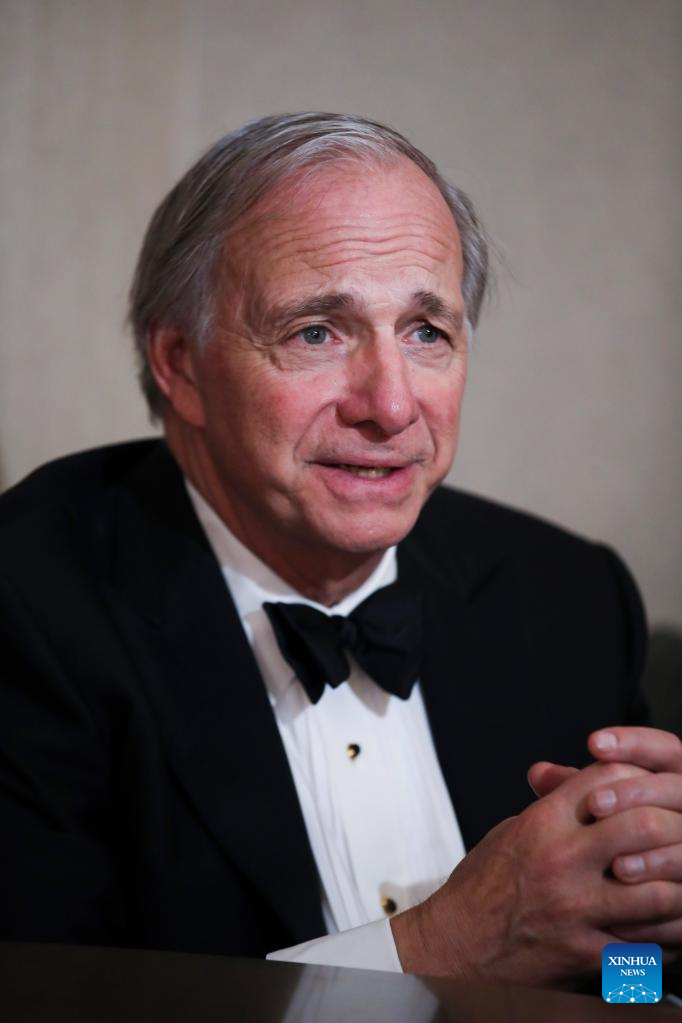

U.S. billionaire investor and hedge fund manager Ray Dalio speaks during an interview with Xinhua in New York, the United States, Feb. 22, 2022. (Xinhua/Wang Ying)

by Xinhua writer Liu Yanan

NEW YORK, Feb. 23 (Xinhua) -- The United States is facing great challenges due to disorder and investors are expected to experience a period of very low investment returns amid high inflation and monetary tightening, U.S. billionaire investor and hedge fund manager Ray Dalio has told Xinhua.

The great risk facing Western powers is political conflict, which is arising from wealth gaps and value gaps, Dalio, founder and co-chief investment officer of top-ranking hedge fund Bridgewater Associates LP, said in an interview with Xinhua on Tuesday on the occasion of the annual gala of the China General Chamber of Commerce - USA.

More inflation and more monetary tightening will have political implications with 2022 being a transition year politically in the United States, he said.

By the time the general elections roll around in 2024, the U.S. economy would be worse than now, which will have political implications, he said, elaborating why he sees the next big risk point being around that time.

Meanwhile, the United States is facing political challenges posed by increasing extremism from both the right and left as well as more populism, he said.

"We may see a situation in which neither side accepts losing and that conflict could be bad," Dalio said.

The economic cycle and the political cycle make it more difficult as each year progresses, he noted.

"It would not be impossible in the 2024 (U.S.) elections to see a type of conflict, a type of civil war" in which rule of the constitution and laws becomes less important to the political parties than winning it, said Dalio.

"The challenge of democracies has always been the question of disorder" and if that process becomes disorderly, then a great deal is lost, and the risks of that are now greater than they were at any point in his lifetime, he said.

One of the three forces shaping the world today is the printing of a lot of money to finance and monetize a lot of debt and that produces inflation, he said.

The world is entering a period of very low returns for quite a few years, said the billionaire.

"Because so much money and so much liquidity were created, the prices of all assets have gone up so much and have driven down the expected returns of those assets," he said.

Dalio said he "would discourage investors from holding any investments in cash and liquid investments" as cash deposits will not provide returns that are adequate to make up for inflation.

The investor also stressed the importance of diversifying investments and his optimistic views on China.

He highlighted the importance of diversification between China and the United States and other places, as well as the diversification of asset classes and the diversification of currencies.

A country's long-term growth is determined by such basic things as the quality of its people's education and having its people work well to be productive to be able to finance their dreams, Dalio said.

"Whatever countries follow those formulas will be strong and will be the strongest. From what I've seen in China, I'm very optimistic about that," he said.

The hedge fund manager also warned that the Chinese and U.S. economies and societies are very much intertwined and it would be disastrous to force the separation of both countries' enterprises or to curtail economic integration between the world's two largest economies. Enditem

(Xinhua writers Pan Lijun, Xing Yue and Zhang Mocheng also contributed to this report.)

U.S. billionaire investor and hedge fund manager Ray Dalio speaks during an interview with Xinhua in New York, the United States, Feb. 22, 2022. (Xinhua/Wang Ying)